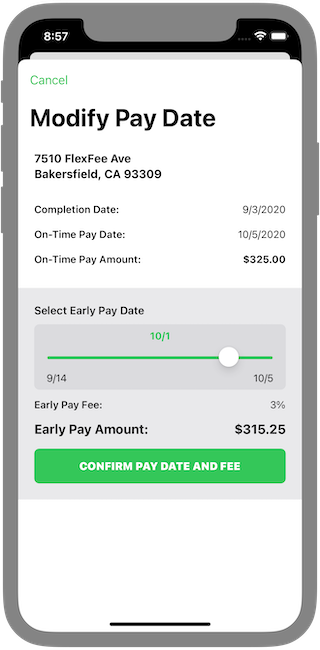

How much will factoring cost me?

It depends on how fast you want to be paid. The discount factor typically ranges from 3% to 10%

The following rules are used when determining when payments are made and what appraisals are included in each payment:

What is “factoring”? In a nutshell, it means you get paid on the date of your choosing, in exchange for a discount factor.

For example, let’s say you have a $100 invoice, and you want to be paid in a week instead of the usual 30 days. We’ll pay you your $100 a week later in exchange for a small fee, say, 5%, so you’d get $95 tomorrow instead of $100 in three weeks.

It depends on how fast you want to be paid. The discount factor typically ranges from 3% to 10%

For payments that you schedule for the same date, you’ll receive one combined payment.

We use Bill.com for all ACH and check payments.

Flex-Fee payments are non-recourse meaning the factor/finance company takes the credit risk to collect the appraisal fee not the vendor (you the Appraiser). Once you, the appraiser are paid you no longer are responsible for the collection of the invoice.

Copyright @ 2022 Flex-Fee